Overview

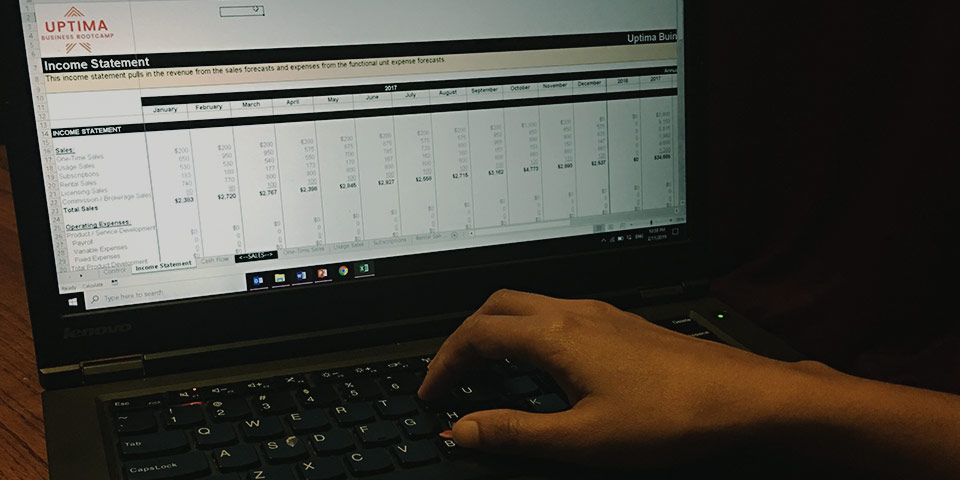

In our Financial Forecasting class, you will gain a basic understanding of the key components of a business’ financial forecast, learn how to create a forecast based on your business plans, and build a financial forecast for your business. This class is 6-weeks long and is well suited for small business owners and startup founders who are looking gain a better understanding of the numbers behind their business and create a realistic financial forecast for growth.